The main functionalities

Through the buttons below, five key elements will be presented to you for applying ICRA Systems in a restructuring process. The software has an intuitive user interface and we offer support so that you can learn to work independently with ICRA Systems within a very short time. We would be happy to make a no-obligation appointment with you for a live demonstration of the application.

How does the ICRA Systems cloud application work?

- Integration of accounting into the application.

- Creditors portal including due diligence room for uniform information provision. Each individual creditor can track their claim, validate it, view classifications of debt and therefore can vote on the agreement.

- Communication with the person involved takes place within the application, allowing for easy and complete filing with the court at a later date.

- Insight into all assets and alignment values with associated collateral.

- Debts are classified into classes.

- Application creates various scenarios and calculations of classifications.

- Insight into liquidation value and value that can be retained.

- Automatic calculations of the different values and the consequences per value for equity providers.

- Integrated voting module that also prepares voting reports for the court.

- Official documentation (e.g. petitions to court or term sheet for new capital structure) prepared semi-automatically.

- In the application you can daily track the progress of the project with related documents.

- Calculation of debt analytics and return calculations of different compositions of capital structures possible.

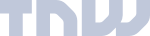

Liabilities and assets

By using the import function, you can load creditors and associated debts. You can then easily insert or modify debt positions manually and attach collateral on assets to individual debt positions.

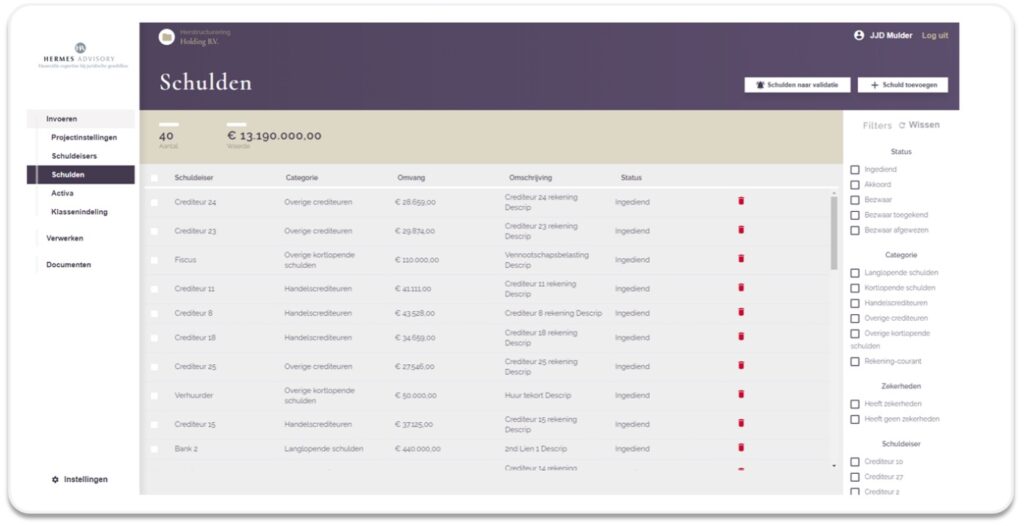

Classification

You can classify creditors into different classes. You can use the impact analysis function to compare the effect of the chosen classification on the recovery rate of each creditor in a bankruptcy situation and in a reorganization in which the agreement is reached. In addition, you can see how important each creditor is per class so that you can estimate which classes will agree and which creditors are important to reach an agreement in each settlement.

Creditor portal

Any creditor or stakeholder can track their claim in the creditor portal. Here, creditors can verify their claim, communicate with the restructuring expert, consultant or trustee about the size of their claim and communicate their collateral position, and see which class their claim is assigned to.

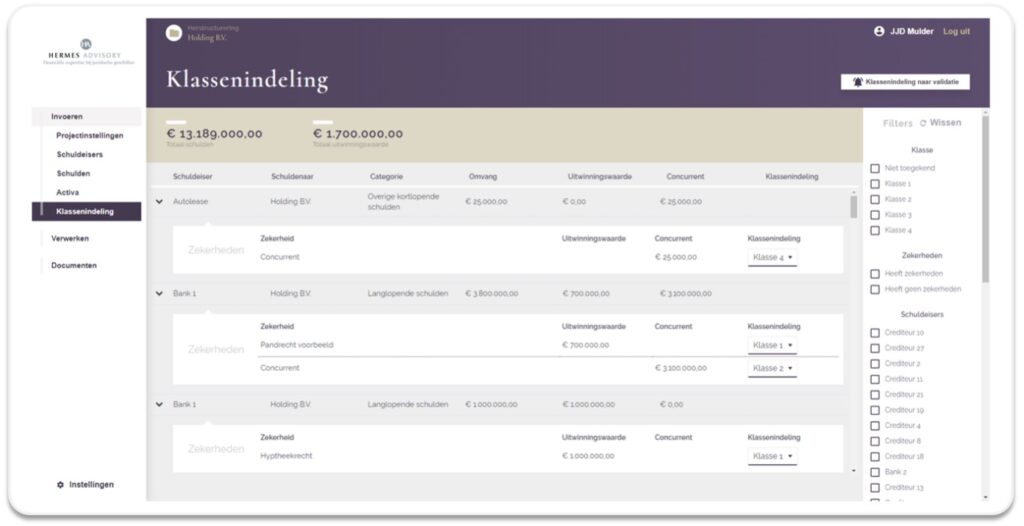

Voting module and voting report

Any creditor or stakeholder can track their claim in the creditor portal. Here, creditors can verify their claim, communicate with the restructuring expert, consultant or trustee about the size of their claim and communicate their collateral position, and see which class their claim is assigned to.

Due diligence room

The company and advisors can store all documents and make them available to creditors through the creditor portal. Here all information can be made available to stakeholders uniformly and (if necessary) by individual stakeholder.

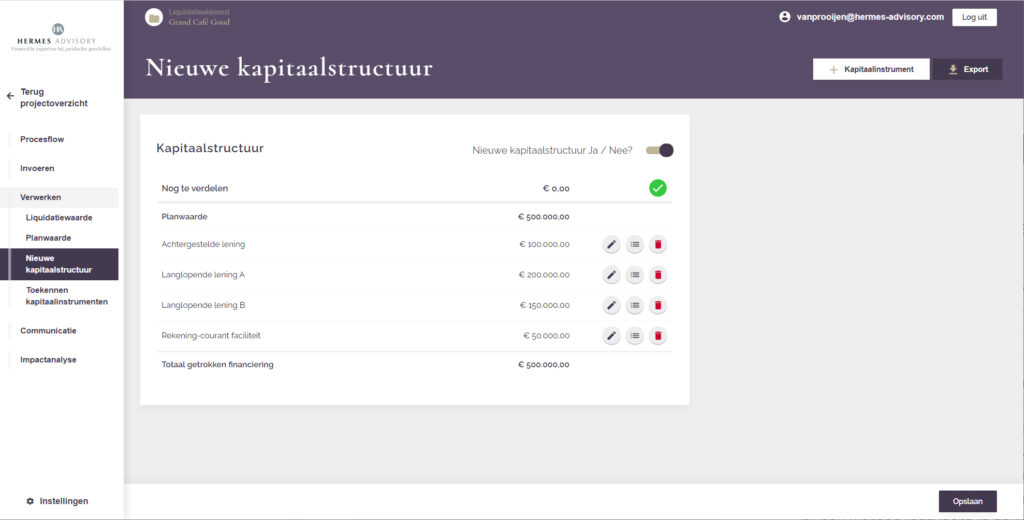

Capital structure

The dept plan should result in maintaining going concern value within the company. In a reorganization agreement, a new capital structure is established. ICRA Systems clarifies how the value within the company is distributed among the beneficiaries. The interpretation of the capital structure can be built using different capital instruments (e.g. normal shares, cumulative preferred shares and debt instruments). The economic and legal conditions of each capital instrument can be entered at a detailed level in the New Capital Structure section. It is also possible to create different scenarios for capital structures and then use the debt analytics tool and the return statements to understand whether the capital structure is sustainable for the company and whether the agreement meets the legal requirements.